florida estate tax exemption 2020

For estates of decedent nonresidents not citizens of the United States the Estate Tax is a tax on the transfer of US-situated property which may include both tangible and. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Ad Our easy-to-use Probate Software helps probate your estate without an expensive attorney.

. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax. The federal government however imposes an estate tax that. Ad Understand The Implications Of A Move To Florida On Your Wealth Estate Plan.

1121 section 1961975 FS PDF 174 KB DR-504W. 1 a A person who on January 1 has the legal title or beneficial title in equity to real property in this. The estate tax exemption in 2021 is 11700000.

As of 2016 the following Estate and Gift tax exemptions are in effect. Real Property Dedicated in Perpetuity for Conservation Exemption. Learn About Floridas Tax Landscape Homestead Laws Property Taxes More.

One of the most important steps is to make. Estate and Gift Tax Exemptions for 2020. The estates executor is also responsible for filing the decedents final income tax return and taking care of any other tax obligations.

Posted on April 28 2016 December 9 2020. Understand the different types of trusts and what that means for your investments. Get information on how the estate tax may apply to your taxable estate at your death.

Tag number and issue date. Ad Valorem Tax Exemption Application and. Click the nifty map below to find the current rates.

Florida Voters Approve Two Property Tax-Related Constitutional Amendments. As a result of recent tax law changes only those who die in 2019 with. As mentioned Florida does not have a separate inheritance death tax.

Learn About Floridas Tax Landscape Homestead Laws Property Taxes More. Download Or Email Form DR-312 More Fillable Forms Register and Subscribe Now. The exemption is subtracted from the assessed value of your home.

A person may be eligible for this exemption if he or she meets the following requirements. 11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Remaining 15000 of value is exempt from non- taxes. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Ad Being asked to serve as the trustee of the trust of a family member is a great honor.

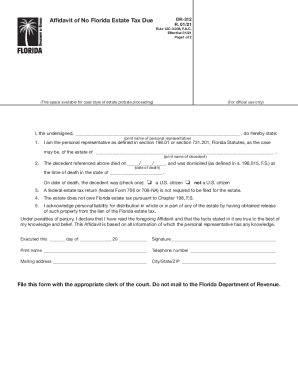

Unified estate tax and gift tax exemption. No Florida estate tax is due for decedents. Application for a Consumers Certificate of Exemption.

Save thousands on lawyers fees by using EZ-Probate. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Economic Development Ad Valorem Property Tax Exemption section 1961995 FS PDF 446 KB DR-418C.

Here are six questions to ask before saying yes. DOC 60 KB PDF 306 KB DR-501. Schedule a free consultation today.

Owns real estate and makes it his or her permanent residence Is age 65 or. Registration Application for Secondhand Dealers andor Secondary Metals Recycler and instructions. Ad Access Tax Forms.

To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue. Assessed Value 85000 The first 25000 of value is exempt from all property tax the next 25000 of value is taxable the third. 196031 Exemption of homesteads.

Federal Estate Taxes. Complete Edit or Print Tax Forms Instantly. Real Property Dedicated in Perpetuity for Conservation Exemption Application R.

Original Application for Homestead and Related Tax. Ad Understand The Implications Of A Move To Florida On Your Wealth Estate Plan. Ad Valorem Tax Exemption Application and Return For Nonprofit Homes for the Aged R.

Florida Estate Planning For Non Citizens Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Inheritance Tax In Florida The Finity Law Firm

Desantis Delivers An Estate Tax Savings Gift For Floridians

State Tax Maps How Does Your State Rank Tax Foundation

Dr 312 Fill Out And Sign Printable Pdf Template Signnow

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Florida Property Tax H R Block

Does Florida Have An Inheritance Tax Alper Law

Florida Estate Tax Rules On Estate Inheritance Taxes

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Does Florida Have An Inheritance Tax Alper Law